As people hit retirement age, they’re on the lookout for smarter ways to make their golden years more enjoyable. Reverse mortgages have become quite the buzzword lately. They’re gaining popularity because they offer flexibility and are pretty straightforward to use.

So, what’s a reverse mortgage exactly?

Simply put, it’s a way to turn some of the value of your home into cash without having to sell it. This can be really handy if you need extra money for things like home repairs or unexpected expenses.

Why is it making such a splash in retirement planning?

Well, reverse mortgages allow you to stay in your home while accessing funds that can make your retirement more comfortable. It’s like having extra cash to cover those unexpected costs or to make your dream retirement a reality.

Lets see why reverse mortgages might be the perfect tool for your retirement plans.

What Is a Reverse Mortgage?

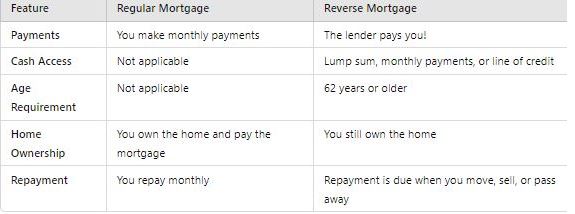

A reverse mortgage is a financial tool designed for homeowners aged 62 and older to turn part of their home’s value into cash without needing to sell their home. It’s different from a traditional mortgage because, instead of making monthly payments to a lender, the lender pays you! Here’s a fun and simple breakdown:

Key Features of a Reverse Mortgage

Age Requirement: You need to be 62 or older to qualify.

Home Equity: You use the value of your home to get cash.

Payment Style: Instead of paying the lender, the lender pays you!

Cash Options: You can choose to receive the cash in different ways:

- Lump Sum: Get all the money at once.

- Monthly Payments: Receive a steady stream of income.

- Line of Credit: Access funds as you need them, like a credit card.

How Does It Work?

Here’s a side-by-side look at how a reverse mortgage stacks up against a regular mortgage:

As Warren Buffett wisely put it,

“The best investment you can make is in yourself.”

A reverse mortgage can be a smart way to invest in your comfort and financial freedom during retirement.

Benefits of a Reverse Mortgage

- Stay in Your Home: You can keep living in your home while accessing cash.

- No Monthly Payments: Enjoy the freedom of not having monthly mortgage payments.

- Flexible Cash Options: Choose how you want to receive your cash based on your needs.

- Tax-Free Cash: The money you receive isn’t considered taxable income.

Things to Consider

– Home Maintenance

You’re still responsible for keeping up with home maintenance, taxes, and insurance.

– Loan Repayment

The loan is repaid when you move out, sell the home, or pass away.

– Impact on Heirs

The amount you owe will be deducted from your home’s value, which may affect what’s left for your heirs.

In short, a reverse mortgage offers a way to unlock some of your home’s value to enjoy during retirement while still living in your home. It’s a flexible and valuable option to consider if you’re looking to enhance your financial situation and enjoy a more comfortable retirement.

Why Are Reverse Mortgages Trending?

Reverse mortgages are becoming a hot topic in the world of retirement finance. Here’s why this financial tool is gaining popularity:

1. Increased Financial Flexibility

Retirement can mean living on a fixed income, which can be tight. A reverse mortgage gives retirees a way to access the money tied up in their home’s value without having to sell it or move. This means you can get extra cash to help with expenses, travel, or just make life a bit easier, all while staying in your home. It’s like adding a new source of income on top of your Social Security or pension, giving you more control over your finances and reducing stress about money.

2. No Monthly Mortgage Payments

One of the best things about a reverse mortgage is that you don’t have to worry about making monthly mortgage payments. You can keep living in your home, just like before, as long as you take care of it, pay your property taxes, and keep up with insurance. The loan only needs to be repaid when you move out, sell the house, or pass away. This can free up a lot of cash each month, making it easier to manage your finances without the added pressure of regular payments.

3. Housing Prices Are Rising

Home values are on the rise in many places, which means the value of your home is likely increasing too. If you’ve been in your home for a while, it’s probably worth a lot more now than when you bought it. A reverse mortgage lets you tap into this growing value and use it to your advantage. By accessing some of that increased equity, you can benefit from your home’s appreciated value and make the most of your financial situation during retirement.

How Reverse Mortgages Are Changing Retirement Planning

Staying in Your Home

Many people want to stay in their own homes as they get older, and a reverse mortgage can help with that. It gives you extra cash to cover things like healthcare, home repairs, or even making your home more accessible. So, you can enjoy your home for years to come without worrying about moving.

Covering Healthcare Costs

Healthcare can get pricey, and that’s where a reverse mortgage comes in handy. It provides some extra money to help with unexpected medical bills, so you don’t have to dig into your savings or sell things you own. It’s like having a financial safety net for those surprise costs.

Fulfilling Your Dreams

Ever wanted to travel the world, start a little business, or help out your grandkids with their education? A reverse mortgage can help make those dreams come true. It gives you extra cash to live the life you’ve always wanted, without feeling strapped for cash.

Things to Think About

Reverse mortgages are pretty cool, but they’re not for everyone. Before diving in, check out the costs, like interest and fees. Also, remember that the loan needs to be paid back eventually, usually when you move out, sell your home, or pass away. So, make sure it’s the right fit for you!

Wrapping It Up

In 2024, revese mortgages are making a big splash as a go-to financial tool for retirees. They offer a flexible way to tap into your home’s value and boost your cash flow while you enjoy your retirement. If you’re looking for extra funds without the hassle of moving out, a reverse mortgage might be just what you need.

Thinking about giving it a try? It’s always a good idea to chat with a financial advisor first. They can help you figure out if a reverse mortgage fits into your retirement plans and make sure it’s the right choice for you.